The global corporate tax rate: Crypto savior or killer?

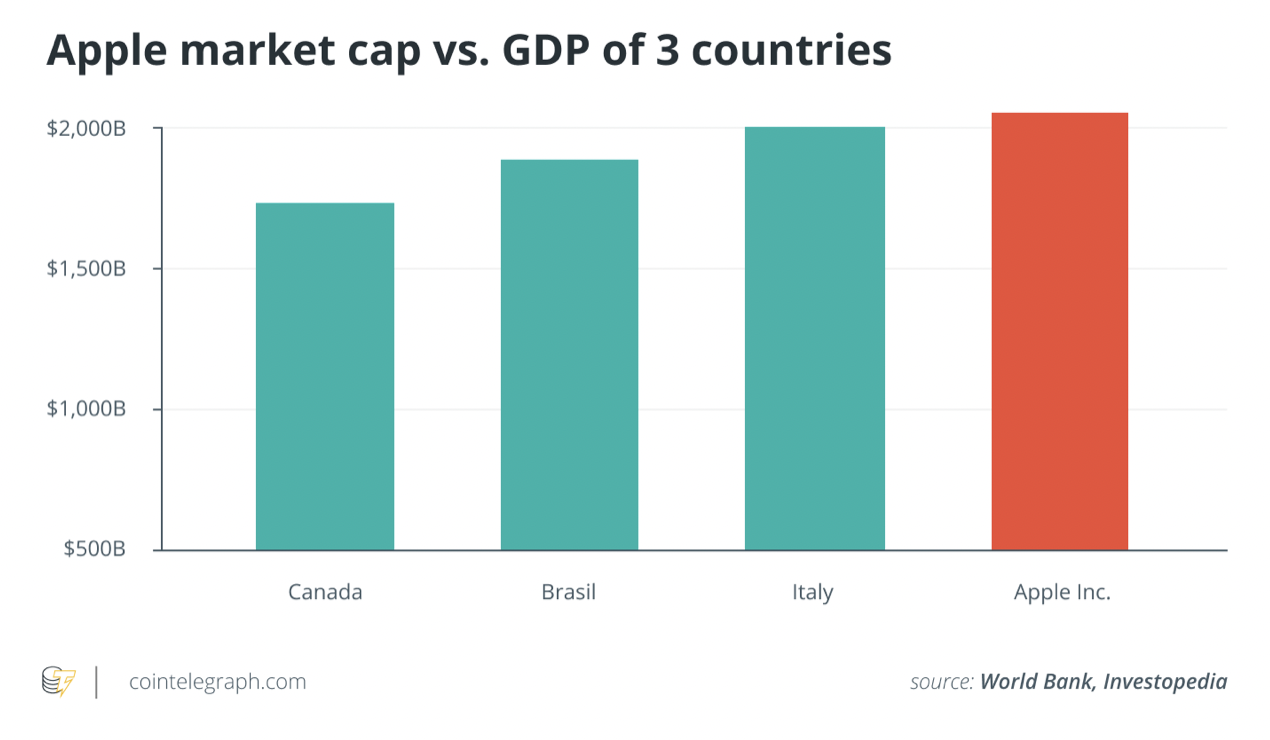

At a meeting in London earlier this month, the finance ministers from the G7 — the United States, Japan, Britain, Germany, France, Italy and Canada — unanimously agreed to begin creating the framework for a global corporate tax rate.

The framework laid out a “two pillar” principle. The first pillar ensures that companies that make a 10% profit margin would be subject to the tax rate. The second pillar ensures that countries will charge a 15% minimum tax rate. Under all of this, the new rules will focus on where the profit was made and not where the company is based — the idea being that companies are discouraged from moving money around the globe, or providing services in one country from another that has a cheaper tax rate.

Read More: Cointelegraph